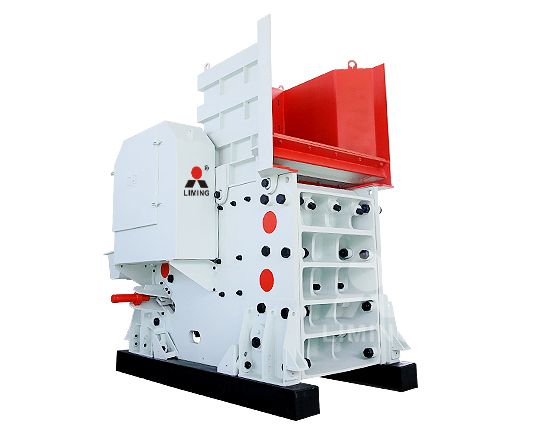

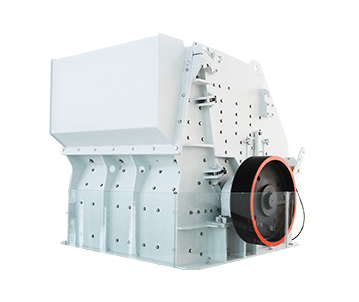

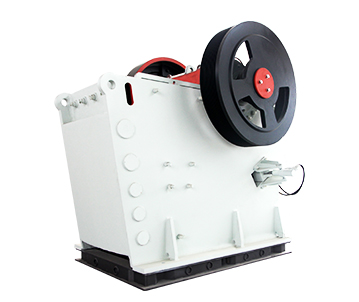

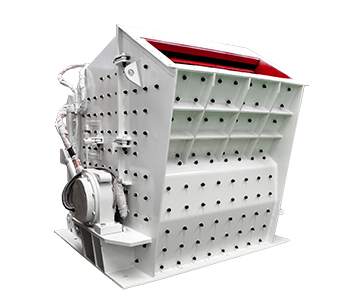

全系产品

PRODUCTOS

SOBRE NOSOTROS

精细化制造,智能化智造

黎明重工深入践行“中国制造2025”,用技术与服务助力制造型企业智能化升级。在互联网+和工业4.0双核驱动下,黎明重工将基于工业互联网时代的重大需求,提供行业内较高的智能技术和品质良好的服务,专注与产业链伙伴一起支持制造业发展,帮助客户实现更高、更快的价值成长。

了解黎明

质量保证

30+发展史

远销170多个国家和地区

40+产品类型

NOTICIAS

企业新闻

08

2022.02

第十一届磨机质量中国行 | 带你看黎明人

岁月更迭,服务的脚步不停歇。黎明重工第十一届磨机质量中国行自8月份启动,如今正进行得如火如荼。该项目使用的是黎明重工MTW欧版磨粉机

07

2022.02

跟踪报道一|2022 砂石服务中国行之山西站

山西,作为资源大省、旅游大省,基础设施建设的战略性、引领性、基础性引导作用更加显著,基建迅猛的发展势头催生着更大更强的破磨装备制造型企业

06

2022.02

价值创享丨“聚焦、专业、专注,一切为了客户的成功

近日,由营销将士、研发工程师、客户服务工程师等组成的多支客户回访团队,星夜兼程、不辞劳苦奔波在黎明重工的服务版图上,2022年磨机

05

2022.02

品牌聚焦 | 黎明重工2022砂石服务中国行已顺利启航!

售后是对质量的承诺,回访是对权益的保障。金秋九月,黎明重工2022砂石服务中国行活动正式起航! 售后是对质量的承诺,回访是对权益的保障